This was one of our most popular blog posts of 2018. We've updated this post with new information to continue providing valuable content.

Blockchain technology is changing the face of financial technology, or FinTech. What is Blockchain and why does it work so well in the finance sector? That’s what we’re unpacking today on the Computer Resources of America blog.

What is Blockchain Technology?

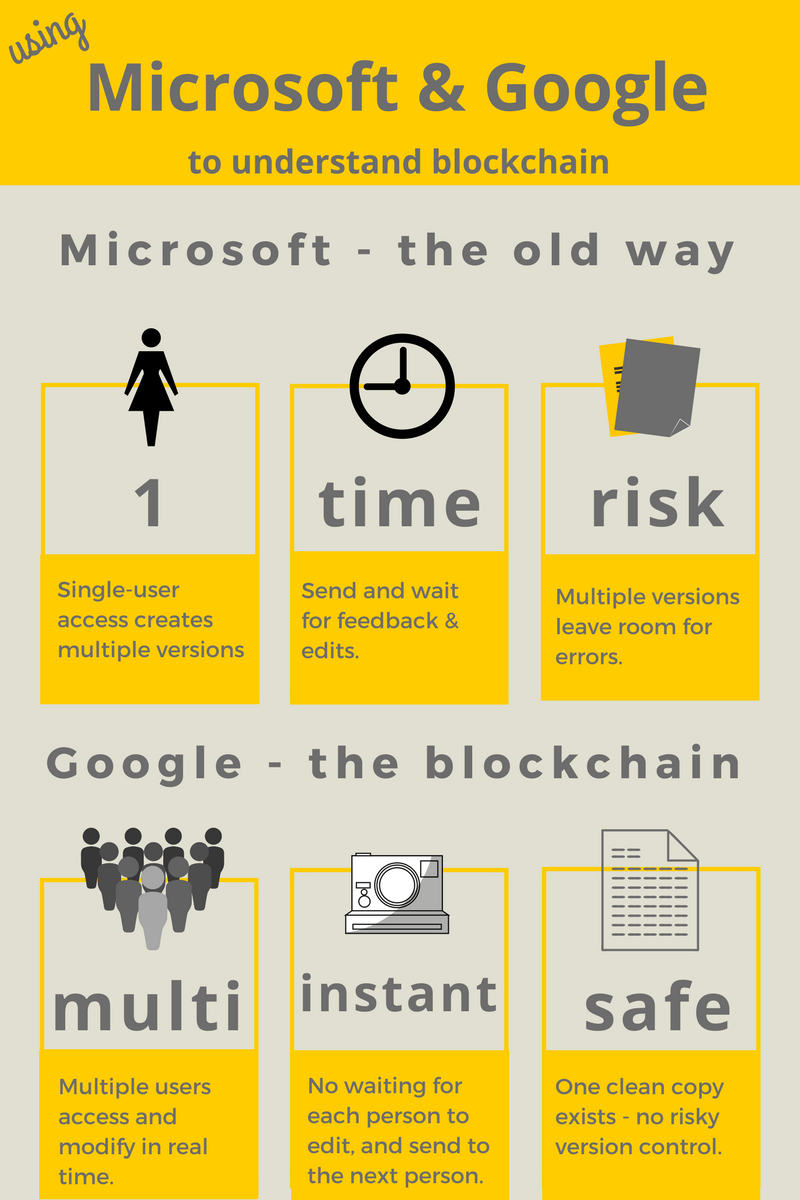

Blockchain, also called “distributed ledger”, is a form of document sharing that allows as many people as necessary access to a file that cannot be copied and is updated in real time. The best analogy for it is the suite of free software aligned with Microsoft vs that from Google.

Many of us are used to working with Microsoft. We create a document or spreadsheet, save it, send it to one person who either comments or suggests edits. They save this and send it back to us. And thus the cycle continues. In the case of finance, this process passes back and forth through several hands. It’s timely and risky - compiling all of those edits and confirming and clarifying kills productivity. Google has made this easier with their suite. Docs and spreadsheets exist in the cloud but can be accessed by anyone with access - the document is always the same; no risks with version control and multiple people can work on it at once.

Traditional ledger software operates like Microsoft. Everyone is locked out when one person is making a change. Blockchain technology allows everyone to access and work in the same document that reconciles every ten minutes.

Blockchain was developed for use with Bitcoin but its use large scale in FinTech is making a tremendous difference.

Update on Blockchain and FinTech

Blockchain technology continued to disrupt the world of finance throughout 2018. It was initially predicted that BitCoin and other cryptocurrencies would be the outcome. It turned out to be the architecture at the virtual money’s foundation that has had the bigger effect on finance.

Cryptocurrency programs built using distributed ledgers showed finance the importance of decision-making while looking at real-time financial data. In addition, distributed ledger or blockchain boosted artificial intelligence and machine learning throughout the financial sector. AI programs better predicted trends and made smarter choices when it came to investments.

How Blockchain Changes FinTech

It Cuts Out the Middleman

Distributed ledger technology was created for use with Bitcoin, the cryptocurrency known for providing anonymity. The multi-access structure, however, shows that it has another benefit: eliminating costly middleman software that charges on both ends. This helps both the gig economy and bigger corporations. Using Fiverr, Uber and other peer-to-peer commerce is great but there are fees to companies that handle the transactions. A blockchain eliminates this. It allows direct payments that don’t require outside help. On a large level, when applied to stock trading for example, confirmations of trades are essentially instant. This means the elimination of unnecessary middlemen like clearinghouses, auditors and custodians.

Philanthropic and entrepreneurial endeavors also see a benefit. Crowdfunding is done directly between the fundraiser and the investors, again eliminating fees.

It Increases Security

Audits are easier and more transparent when there’s blockchain tech in place in financial technology. Timestamps and user data guarantee the authenticity of transactions, goods, services and expenses.

In addition, blockchain technology affords copyrighted works protection as well as protects the sale of creative works online.

Finally, blockchain enables better identity verification. This creates a safer, more transparent process no matter what transactions are taking place.

A Flash In The Pan?

Nope. While blockchain has been on the radar since 2016 it’s caught on in 2017 and won’t go anywhere soon. One of the best metrics for this is its incorporation by major players on the financial scene like J.P. Morgan and IBM.

This month CRA is covering the financial sector. Come back next week for our post on the implications of the new tax law. We’ll break it down to make it easy to understand and legalese free, like we did with changes to the American Bar Association guidelines for tech and the law.

Works consulted: Fintech Singapore, Blockgeeks, Computerworld, and Computerworld